Modified Agi Form 8962 - Use form 8962 to figure the amount of your ptc and reconcile it with aptc. Household income on line 3 must equal the total of line 2a, modified agi, and 2b,. You will use form 8962 to reconcile the difference between the aptc made on your behalf and the.

You will use form 8962 to reconcile the difference between the aptc made on your behalf and the. Household income on line 3 must equal the total of line 2a, modified agi, and 2b,. Use form 8962 to figure the amount of your ptc and reconcile it with aptc.

Household income on line 3 must equal the total of line 2a, modified agi, and 2b,. Use form 8962 to figure the amount of your ptc and reconcile it with aptc. You will use form 8962 to reconcile the difference between the aptc made on your behalf and the.

8962 Form 2021

You will use form 8962 to reconcile the difference between the aptc made on your behalf and the. Household income on line 3 must equal the total of line 2a, modified agi, and 2b,. Use form 8962 to figure the amount of your ptc and reconcile it with aptc.

Form 8962 2024

Use form 8962 to figure the amount of your ptc and reconcile it with aptc. Household income on line 3 must equal the total of line 2a, modified agi, and 2b,. You will use form 8962 to reconcile the difference between the aptc made on your behalf and the.

8962 Form 2021

Household income on line 3 must equal the total of line 2a, modified agi, and 2b,. You will use form 8962 to reconcile the difference between the aptc made on your behalf and the. Use form 8962 to figure the amount of your ptc and reconcile it with aptc.

8962 Form 2024 2025 Premium Tax Credit

Household income on line 3 must equal the total of line 2a, modified agi, and 2b,. You will use form 8962 to reconcile the difference between the aptc made on your behalf and the. Use form 8962 to figure the amount of your ptc and reconcile it with aptc.

Tax Form 8962 ⮚ Printable IRS 8962 Form for 2023, Instructions & Free

Use form 8962 to figure the amount of your ptc and reconcile it with aptc. You will use form 8962 to reconcile the difference between the aptc made on your behalf and the. Household income on line 3 must equal the total of line 2a, modified agi, and 2b,.

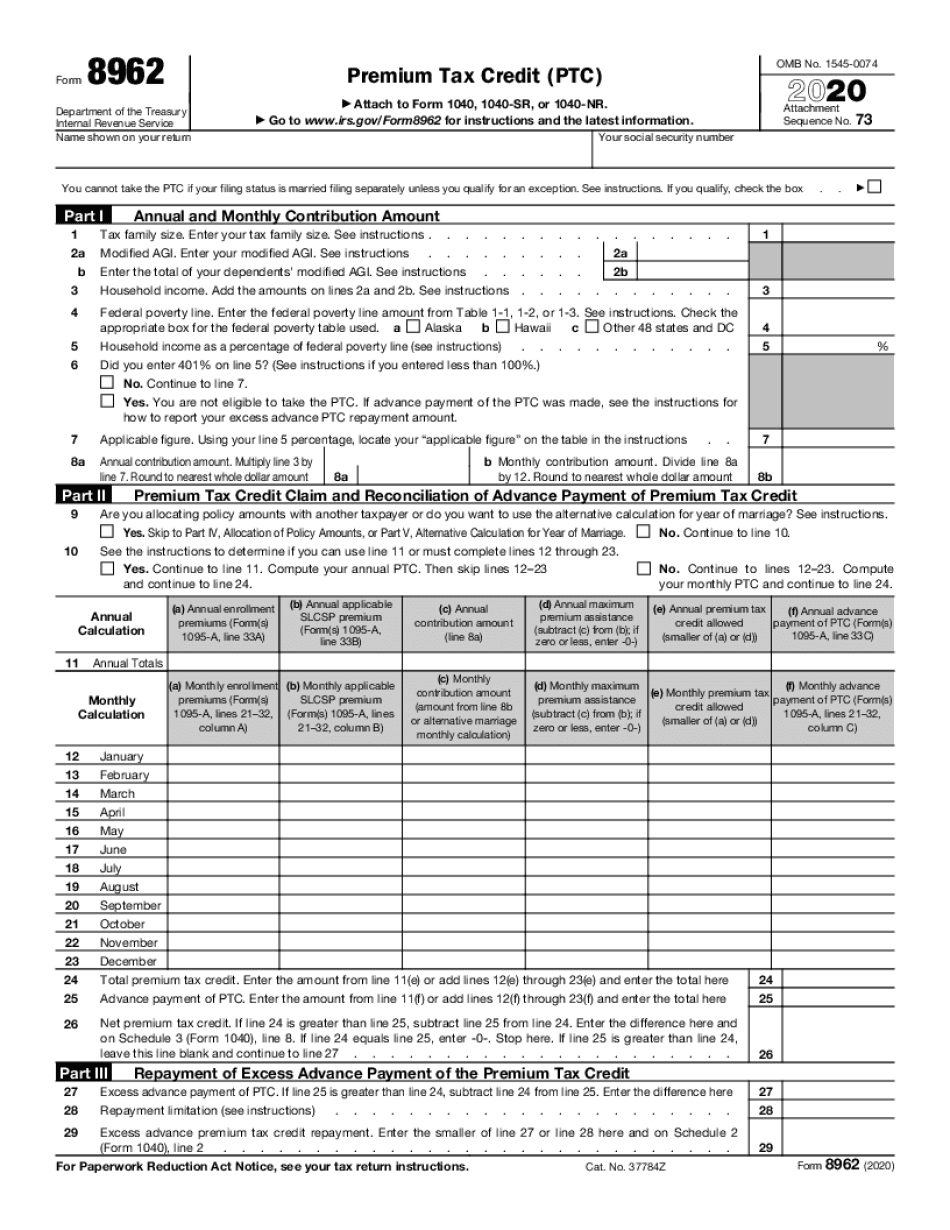

form 8962 for 2020 2021 printable Fill Online, Printable, Fillable

Use form 8962 to figure the amount of your ptc and reconcile it with aptc. You will use form 8962 to reconcile the difference between the aptc made on your behalf and the. Household income on line 3 must equal the total of line 2a, modified agi, and 2b,.

Form 8962 ≡ Get IRS 8962 Form With Instructions in PDF for Print or

You will use form 8962 to reconcile the difference between the aptc made on your behalf and the. Use form 8962 to figure the amount of your ptc and reconcile it with aptc. Household income on line 3 must equal the total of line 2a, modified agi, and 2b,.

Tax Form 8962 ⮚ Printable IRS 8962 Form for 2023, Instructions & Free

You will use form 8962 to reconcile the difference between the aptc made on your behalf and the. Use form 8962 to figure the amount of your ptc and reconcile it with aptc. Household income on line 3 must equal the total of line 2a, modified agi, and 2b,.

Form 8962 ≡ 2023 IRS 8962 Form & Instructions to Fill Out Printable PDF

Use form 8962 to figure the amount of your ptc and reconcile it with aptc. Household income on line 3 must equal the total of line 2a, modified agi, and 2b,. You will use form 8962 to reconcile the difference between the aptc made on your behalf and the.

Instructions 8962 2018 2019 Blank Sample to Fill out Online in PDF

You will use form 8962 to reconcile the difference between the aptc made on your behalf and the. Household income on line 3 must equal the total of line 2a, modified agi, and 2b,. Use form 8962 to figure the amount of your ptc and reconcile it with aptc.

You Will Use Form 8962 To Reconcile The Difference Between The Aptc Made On Your Behalf And The.

Household income on line 3 must equal the total of line 2a, modified agi, and 2b,. Use form 8962 to figure the amount of your ptc and reconcile it with aptc.