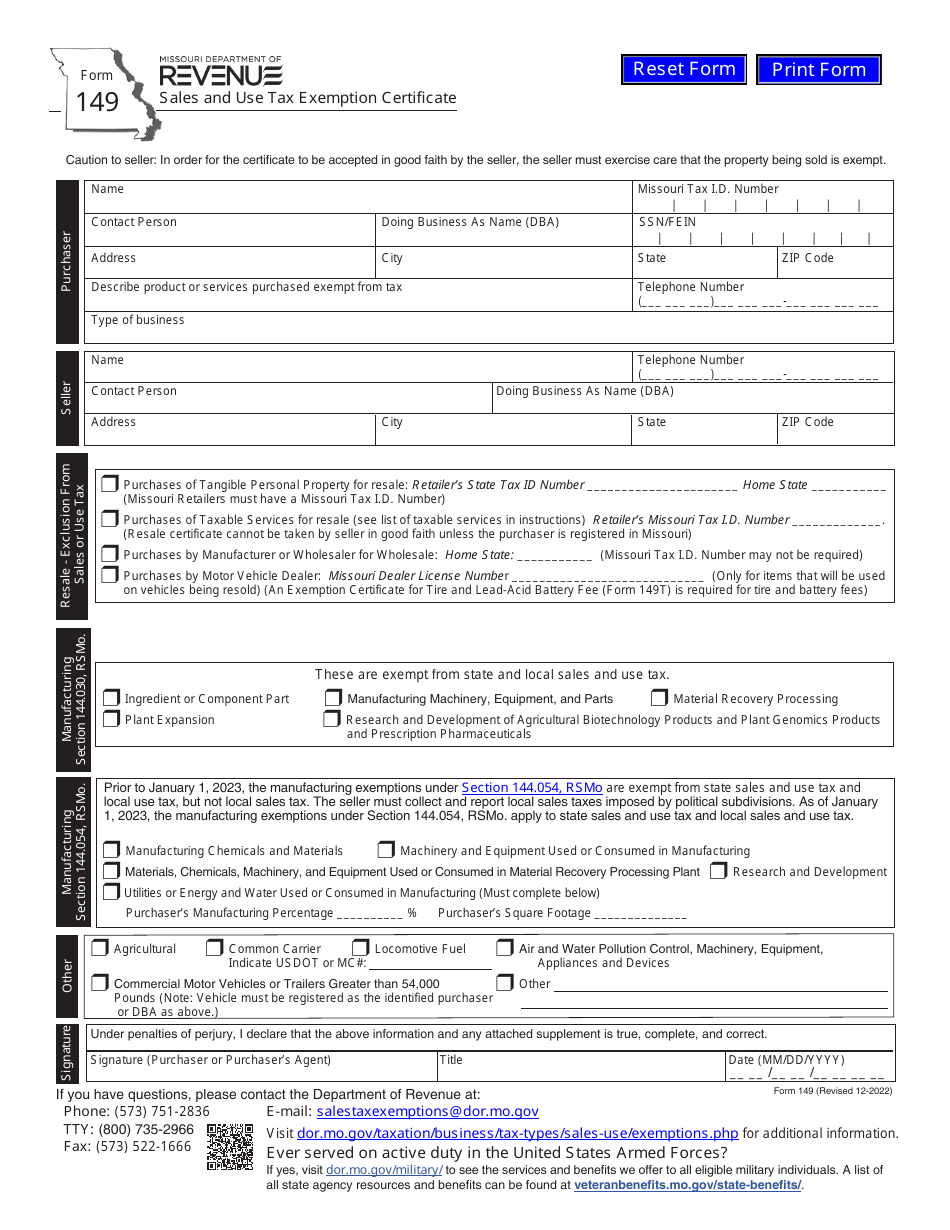

Missouri Hotel Tax Exempt Form - Show — utility bar hide — utility bar. The hotel tax exemption missouri form is a certificate that allows eligible individuals or. Excellent customer service, every time. Generally, missouri taxes all retail sales of tangible personal property and certain taxable. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri. Download or print the 2024 missouri form 149 (sales and use tax exemption certificate) for.

Excellent customer service, every time. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri. Show — utility bar hide — utility bar. Generally, missouri taxes all retail sales of tangible personal property and certain taxable. The hotel tax exemption missouri form is a certificate that allows eligible individuals or. Download or print the 2024 missouri form 149 (sales and use tax exemption certificate) for.

Excellent customer service, every time. Generally, missouri taxes all retail sales of tangible personal property and certain taxable. Download or print the 2024 missouri form 149 (sales and use tax exemption certificate) for. The hotel tax exemption missouri form is a certificate that allows eligible individuals or. Show — utility bar hide — utility bar. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri.

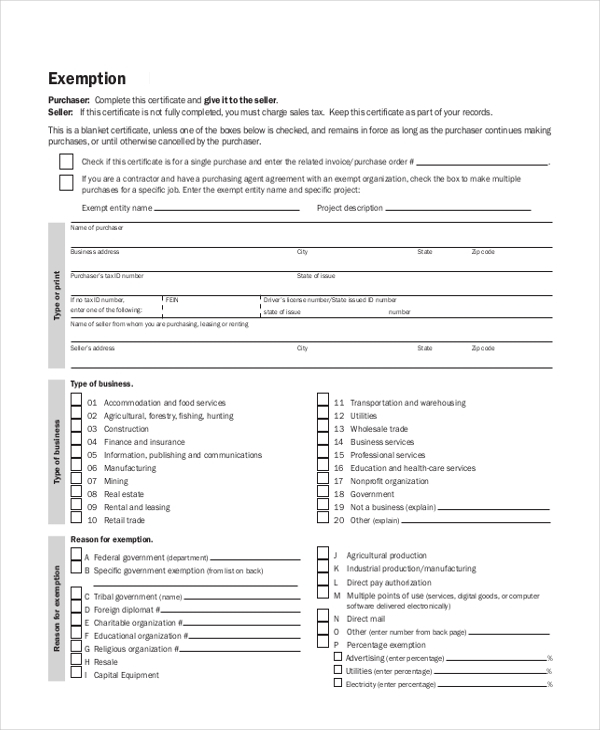

FREE 10 Sample Tax Exemption Forms In PDF MS Word

Generally, missouri taxes all retail sales of tangible personal property and certain taxable. Show — utility bar hide — utility bar. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri. Excellent customer service, every time. The hotel tax exemption missouri form is a certificate that allows eligible individuals or.

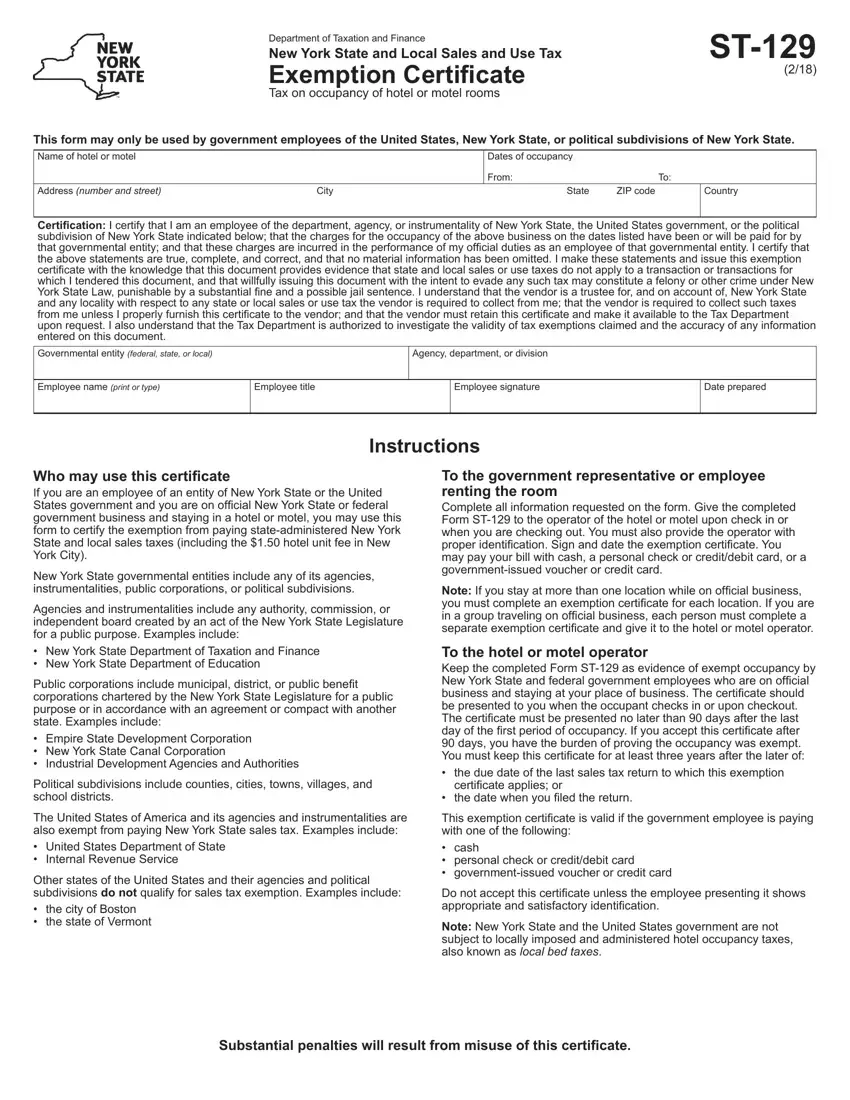

New York Hotel Tax Exempt Form ≡ Fill Out Printable PDF Forms Online

Excellent customer service, every time. Show — utility bar hide — utility bar. Generally, missouri taxes all retail sales of tangible personal property and certain taxable. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri. Download or print the 2024 missouri form 149 (sales and use tax exemption certificate) for.

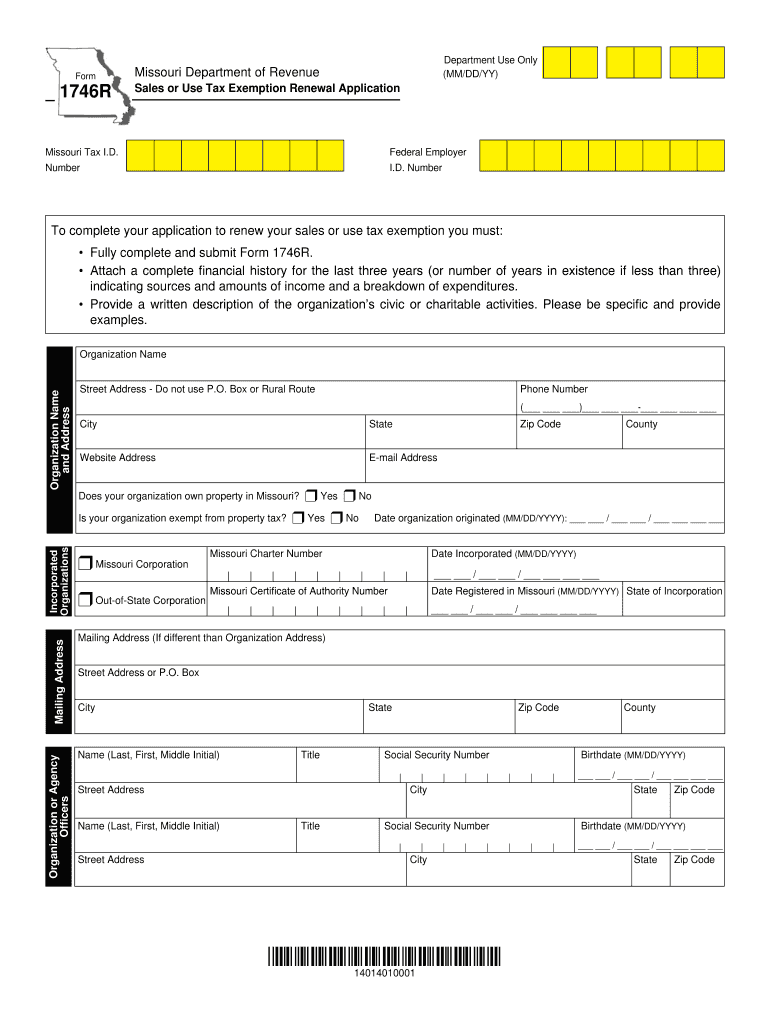

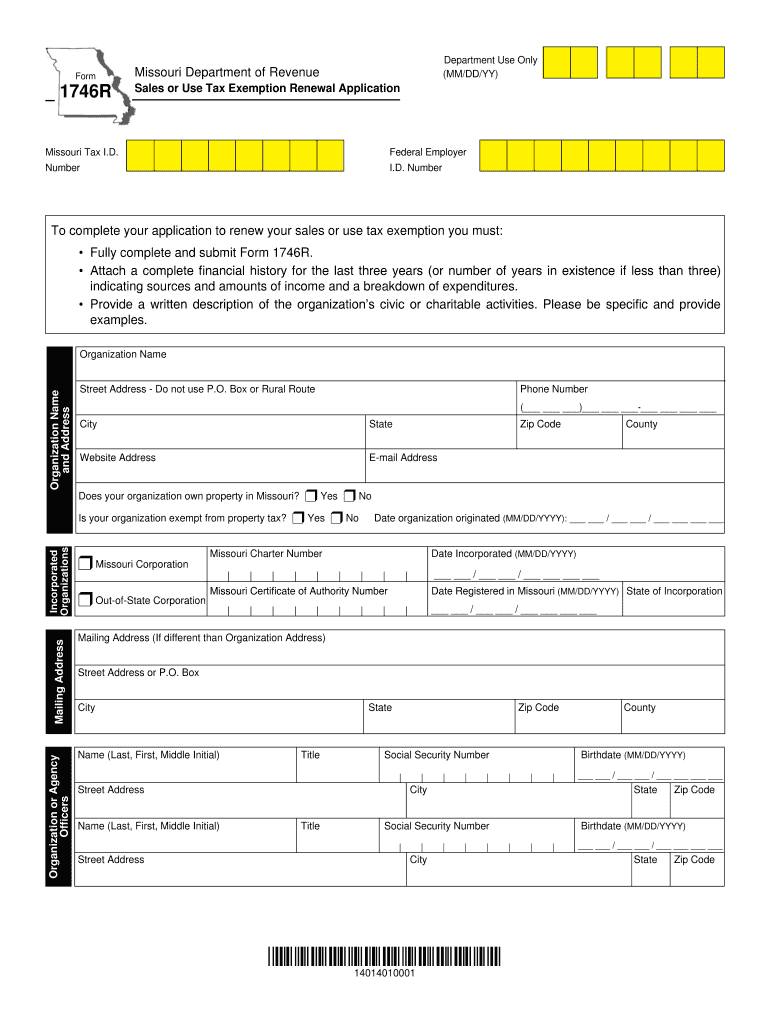

Missouri Farm Taxexempt Form

Show — utility bar hide — utility bar. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri. Generally, missouri taxes all retail sales of tangible personal property and certain taxable. Excellent customer service, every time. Download or print the 2024 missouri form 149 (sales and use tax exemption certificate) for.

Missouri W9 2021 Example Calendar Printable

Generally, missouri taxes all retail sales of tangible personal property and certain taxable. Show — utility bar hide — utility bar. Download or print the 2024 missouri form 149 (sales and use tax exemption certificate) for. The hotel tax exemption missouri form is a certificate that allows eligible individuals or. Excellent customer service, every time.

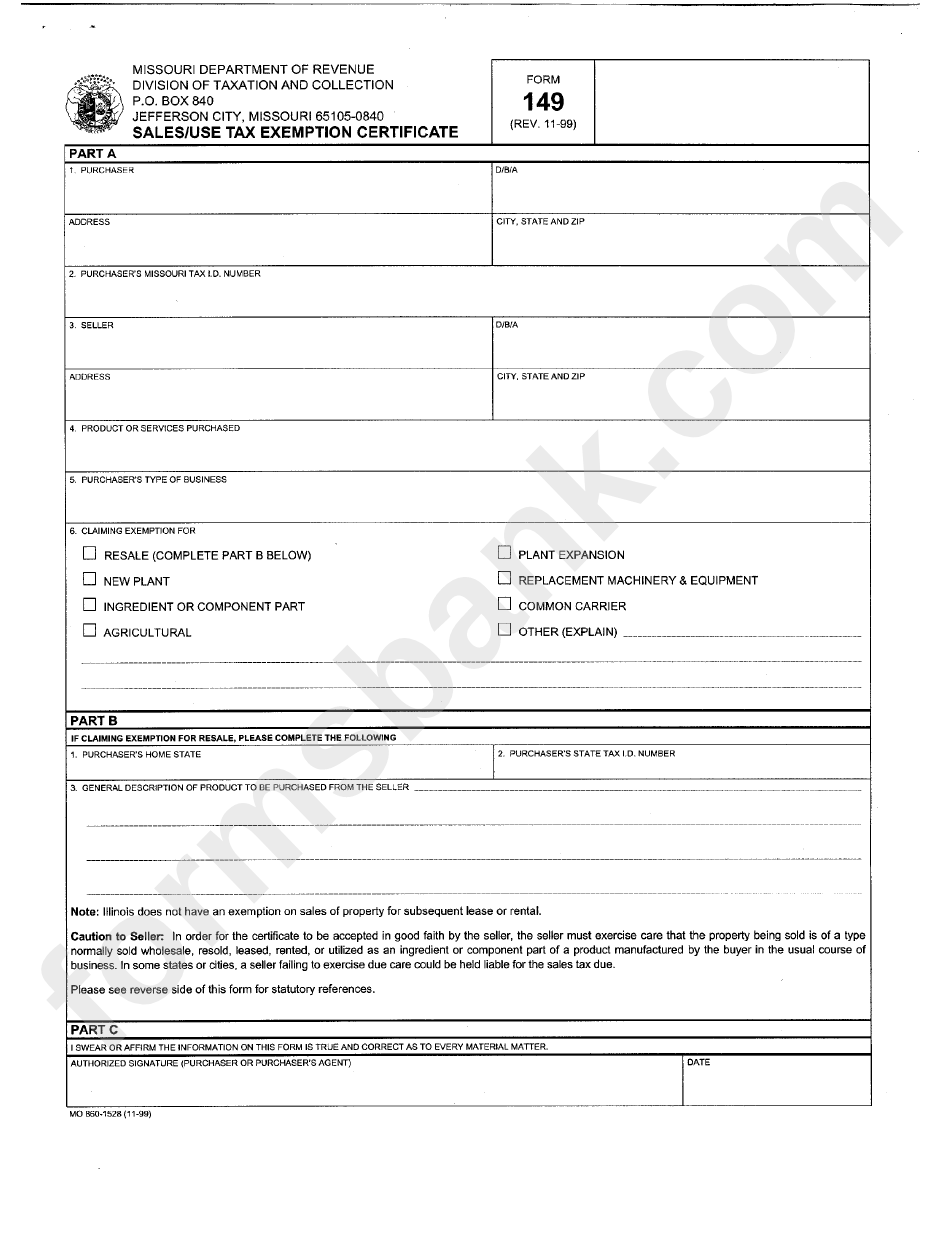

Missouri Sales Tax Exemption Certificate Form

Download or print the 2024 missouri form 149 (sales and use tax exemption certificate) for. The hotel tax exemption missouri form is a certificate that allows eligible individuals or. Excellent customer service, every time. Generally, missouri taxes all retail sales of tangible personal property and certain taxable. To qualify, the product must ultimately be subject to sales or use tax,.

Fillable Missouri Tax Exempt Form 149 Printable Forms Free Online

Generally, missouri taxes all retail sales of tangible personal property and certain taxable. Excellent customer service, every time. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri. Show — utility bar hide — utility bar. Download or print the 2024 missouri form 149 (sales and use tax exemption certificate) for.

Printable Missouri Sales Tax Exemption Certificates

Generally, missouri taxes all retail sales of tangible personal property and certain taxable. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri. Excellent customer service, every time. Download or print the 2024 missouri form 149 (sales and use tax exemption certificate) for. Show — utility bar hide — utility bar.

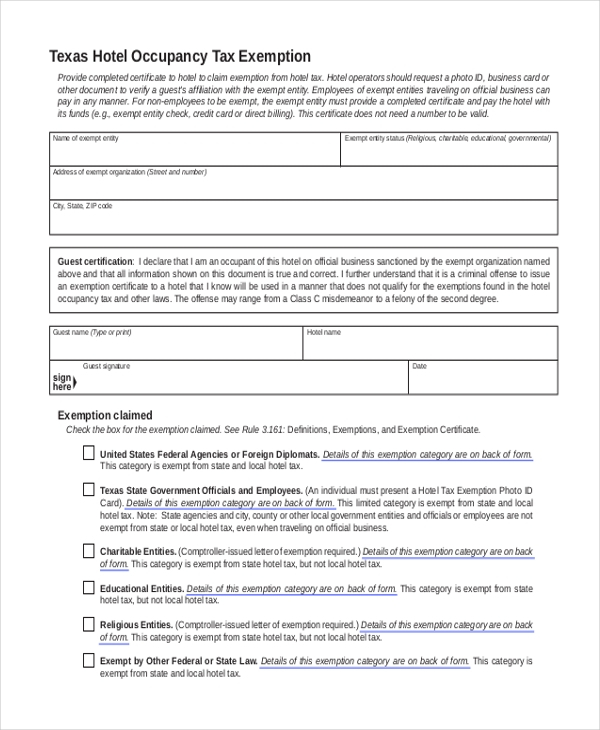

Tax Exempt Lodging Form

To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri. Show — utility bar hide — utility bar. Excellent customer service, every time. The hotel tax exemption missouri form is a certificate that allows eligible individuals or. Download or print the 2024 missouri form 149 (sales and use tax exemption certificate) for.

Federal Tax Exempt Certificate Master of Documents

Generally, missouri taxes all retail sales of tangible personal property and certain taxable. The hotel tax exemption missouri form is a certificate that allows eligible individuals or. Show — utility bar hide — utility bar. Excellent customer service, every time. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri.

Missouri Tax Exempt Form

Show — utility bar hide — utility bar. The hotel tax exemption missouri form is a certificate that allows eligible individuals or. Generally, missouri taxes all retail sales of tangible personal property and certain taxable. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri. Download or print the 2024 missouri form.

Excellent Customer Service, Every Time.

The hotel tax exemption missouri form is a certificate that allows eligible individuals or. Show — utility bar hide — utility bar. To qualify, the product must ultimately be subject to sales or use tax, or its equivalent, in missouri. Download or print the 2024 missouri form 149 (sales and use tax exemption certificate) for.