Lower Tax Rate That Prevents The Company From Being Double-Taxed - To avoid double taxation, consider becoming an llc or an s corporation. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Legal structure to avoid double taxation. Both have their own benefits and tax perks. Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. Following are some of the most common strategies to save on taxes:

Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. Legal structure to avoid double taxation. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Following are some of the most common strategies to save on taxes: To avoid double taxation, consider becoming an llc or an s corporation. Both have their own benefits and tax perks.

Following are some of the most common strategies to save on taxes: Legal structure to avoid double taxation. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Both have their own benefits and tax perks. To avoid double taxation, consider becoming an llc or an s corporation.

How to Lower Your Effective Tax Rate The Motley Fool

A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Following are some of the most common strategies to save on taxes: To avoid double taxation, consider becoming an llc or an s corporation. Because progressive tax brackets affect c corps and individuals, income splitting can.

Lower Tax Rates. More Jobs. GOT IT? Job Creators Network

Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Legal structure to avoid double taxation..

CONVERSABLE ECONOMIST Lower Tax Rates or Less Tax Enforcement?

Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Both have their own benefits and tax perks. To avoid double taxation, consider becoming an llc or an s corporation. Following.

CONVERSABLE ECONOMIST Lower Tax Rates or Less Tax Enforcement?

Both have their own benefits and tax perks. Legal structure to avoid double taxation. Following are some of the most common strategies to save on taxes: A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Because progressive tax brackets affect c corps and individuals, income.

Five Tips to Lower Taxes For Small Businesses Elite Tax

Legal structure to avoid double taxation. Both have their own benefits and tax perks. To avoid double taxation, consider becoming an llc or an s corporation. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation.

The Unassuming Economist Does Globalization Lower Tax Rates?

Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Following are some of the most.

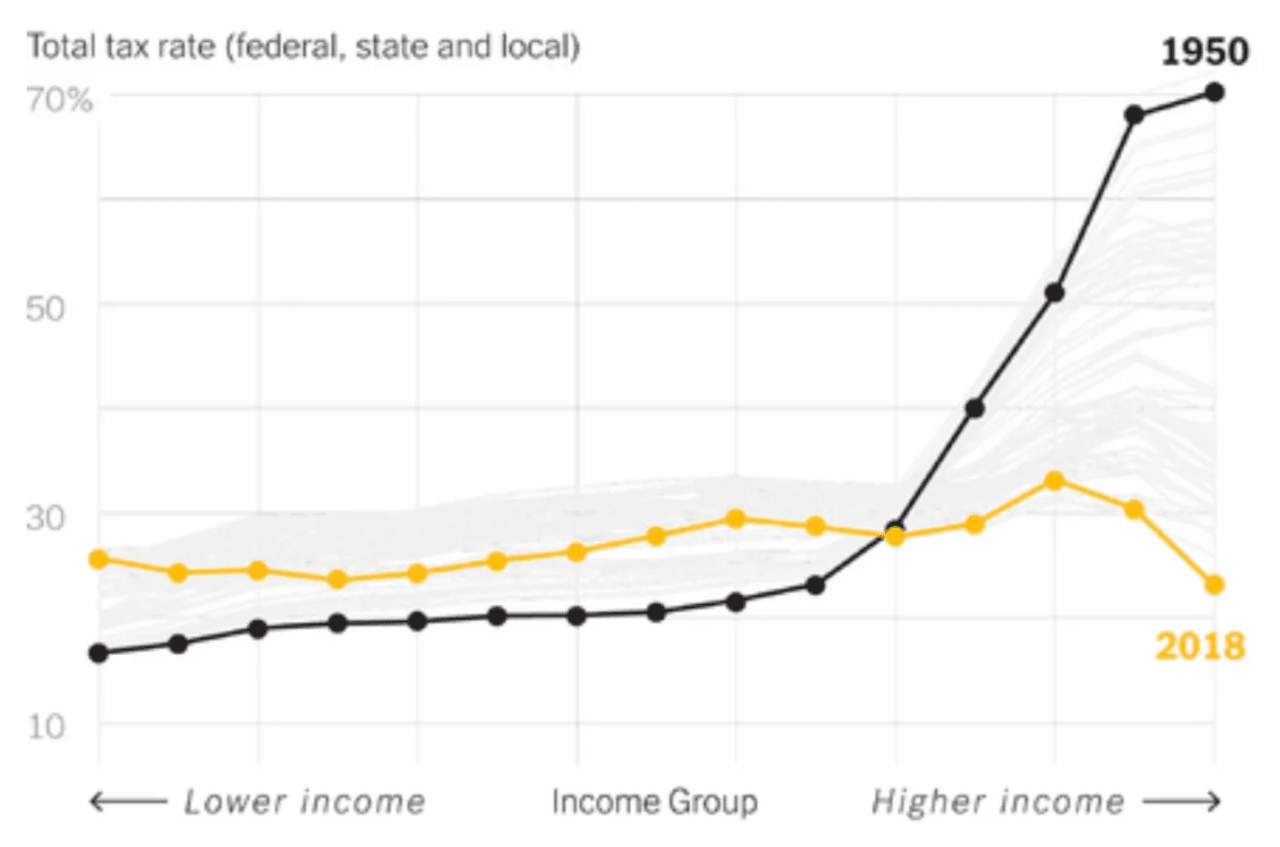

Economists America's Elite Pay Lower Tax Rate Than All Other Americans

Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. Legal structure to avoid double taxation. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp..

What Is the Corporate Tax Rate? Federal & State Tax Rates

Both have their own benefits and tax perks. Legal structure to avoid double taxation. Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. A legal structure with a lower tax rate that prevents a company from being double taxed.

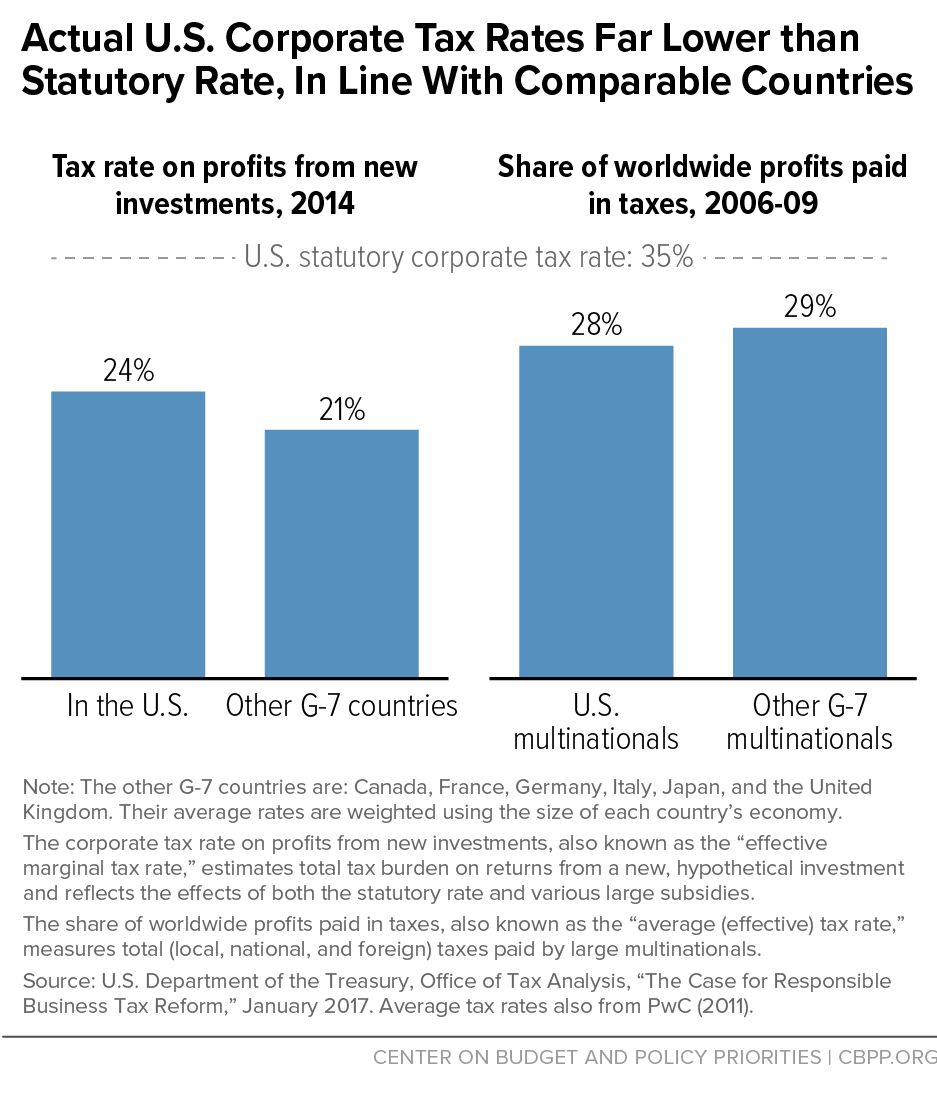

Actual U.S. Corporate Tax Rates Far Lower than Statutory Rate, In Line

Legal structure to avoid double taxation. Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. Both have their own benefits and tax perks. Following are some of the most common strategies to save on taxes: A legal structure with a lower tax rate that prevents a company from being double taxed is called an.

The Buffett Series A lower Tax Rate? — Investment Masters Class

Following are some of the most common strategies to save on taxes: Because progressive tax brackets affect c corps and individuals, income splitting can minimize double taxation. To avoid double taxation, consider becoming an llc or an s corporation. Both have their own benefits and tax perks. Profits are taxed when earned, and then the shareholders' dividends are taxed after.

To Avoid Double Taxation, Consider Becoming An Llc Or An S Corporation.

Profits are taxed when earned, and then the shareholders' dividends are taxed after they are. Both have their own benefits and tax perks. A legal structure with a lower tax rate that prevents a company from being double taxed is called an s corporation or s corp. Following are some of the most common strategies to save on taxes:

Because Progressive Tax Brackets Affect C Corps And Individuals, Income Splitting Can Minimize Double Taxation.

Legal structure to avoid double taxation.