Eidl Loan Bankruptcy Discharge - An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. Discover if eidl loans can be discharged in bankruptcy. Learn about the legal implications, pros, cons, and case laws in this. Learn how these loans are dischargeable in bankruptcy, but subject to sba rules and government review. If you closed your business and have outstanding debt on a loan through the eidl program of less than $25,000, there is little (if.

Learn how these loans are dischargeable in bankruptcy, but subject to sba rules and government review. An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. Discover if eidl loans can be discharged in bankruptcy. Learn about the legal implications, pros, cons, and case laws in this. If you closed your business and have outstanding debt on a loan through the eidl program of less than $25,000, there is little (if.

If you closed your business and have outstanding debt on a loan through the eidl program of less than $25,000, there is little (if. An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. Learn about the legal implications, pros, cons, and case laws in this. Learn how these loans are dischargeable in bankruptcy, but subject to sba rules and government review. Discover if eidl loans can be discharged in bankruptcy.

Can I Discharge PPP and EIDL Loans in My Bankruptcy?

Learn about the legal implications, pros, cons, and case laws in this. Discover if eidl loans can be discharged in bankruptcy. An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. Learn how these loans are dischargeable in bankruptcy, but subject to sba rules and government review. If you closed your business and.

Can I Discharge PPP and EIDL Loans in My Bankruptcy?

If you closed your business and have outstanding debt on a loan through the eidl program of less than $25,000, there is little (if. An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. Learn about the legal implications, pros, cons, and case laws in this. Learn how these loans are dischargeable in.

Can You File Bankruptcy And Include An SBA EIDL Loan?

Learn about the legal implications, pros, cons, and case laws in this. Discover if eidl loans can be discharged in bankruptcy. Learn how these loans are dischargeable in bankruptcy, but subject to sba rules and government review. An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. If you closed your business and.

Update on Discharging SBA EIDL Loans in Chapter 13 or Chapter 7

An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. Learn about the legal implications, pros, cons, and case laws in this. Learn how these loans are dischargeable in bankruptcy, but subject to sba rules and government review. If you closed your business and have outstanding debt on a loan through the eidl.

Can SBA Loans Be Discharged in Bankruptcy? Fleysher Law

Discover if eidl loans can be discharged in bankruptcy. Learn about the legal implications, pros, cons, and case laws in this. An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. Learn how these loans are dischargeable in bankruptcy, but subject to sba rules and government review. If you closed your business and.

Can I Discharge My SBA EIDL Loan if I File Bankruptcy in CA?

Learn about the legal implications, pros, cons, and case laws in this. Learn how these loans are dischargeable in bankruptcy, but subject to sba rules and government review. An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. If you closed your business and have outstanding debt on a loan through the eidl.

Can EIDL Loans be Included in Bankruptcy. Economic Injury Disaster

An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. Learn how these loans are dischargeable in bankruptcy, but subject to sba rules and government review. Learn about the legal implications, pros, cons, and case laws in this. Discover if eidl loans can be discharged in bankruptcy. If you closed your business and.

EIDL LOAN BANKRUPTCY for SBA loans to Small Business Can You File

Learn about the legal implications, pros, cons, and case laws in this. An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. Discover if eidl loans can be discharged in bankruptcy. If you closed your business and have outstanding debt on a loan through the eidl program of less than $25,000, there is.

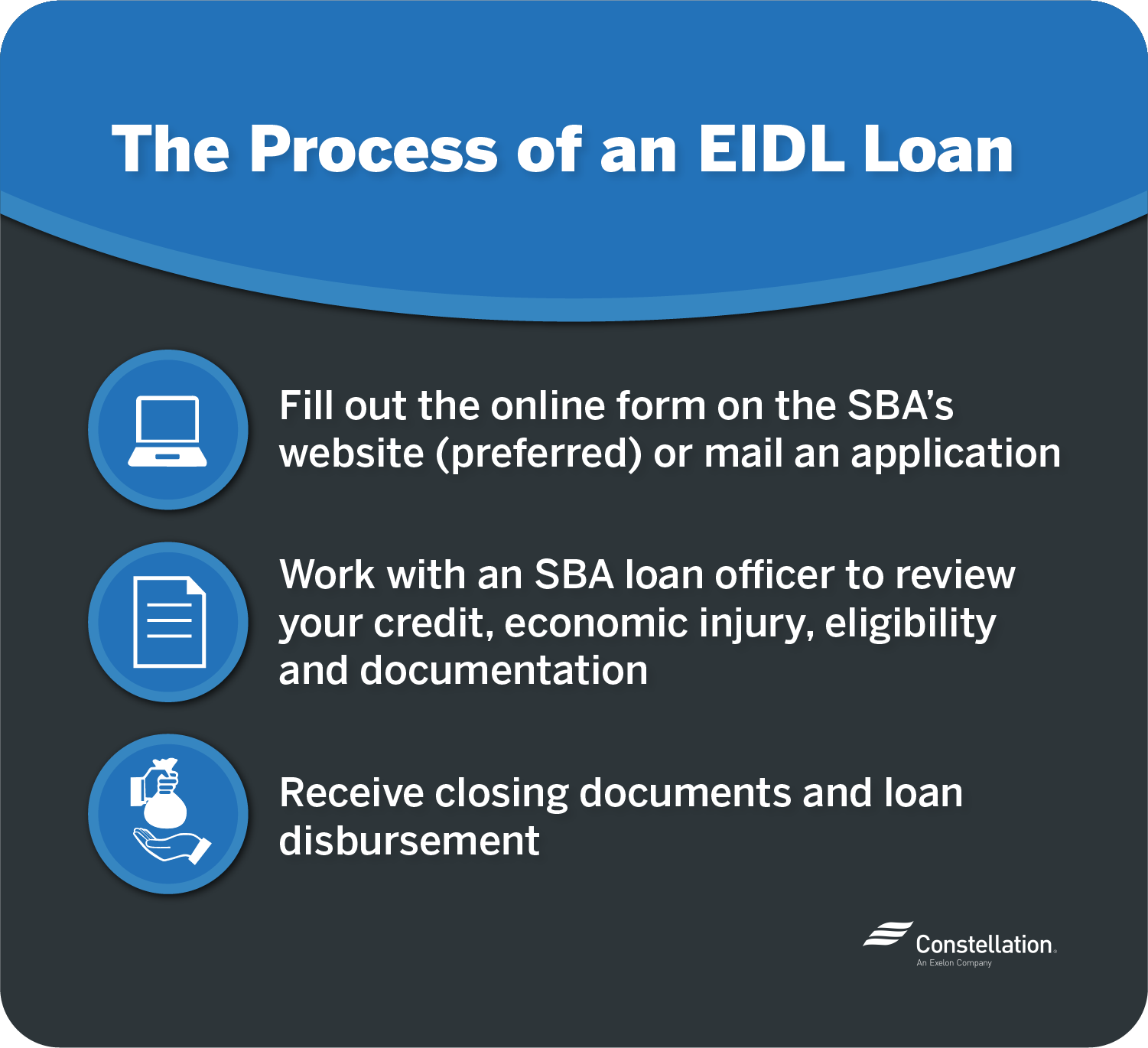

How to Apply for SBA Disaster Loans Constellation

If you closed your business and have outstanding debt on a loan through the eidl program of less than $25,000, there is little (if. Learn how these loans are dischargeable in bankruptcy, but subject to sba rules and government review. Discover if eidl loans can be discharged in bankruptcy. An economic injury disaster loan can potentially be discharged in a.

Can I File Bankruptcy If I Have PPP & EIDL Loans?

If you closed your business and have outstanding debt on a loan through the eidl program of less than $25,000, there is little (if. An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. Learn about the legal implications, pros, cons, and case laws in this. Discover if eidl loans can be discharged.

Discover If Eidl Loans Can Be Discharged In Bankruptcy.

Learn how these loans are dischargeable in bankruptcy, but subject to sba rules and government review. Learn about the legal implications, pros, cons, and case laws in this. An economic injury disaster loan can potentially be discharged in a business bankruptcy, depending on the circumstances. If you closed your business and have outstanding debt on a loan through the eidl program of less than $25,000, there is little (if.