Do Daycares Provide Tax Forms - Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of. The answer is yes, most daycares will provide you with a tax form. When you earn money as a daycare provider, even if only a small amount, those earnings are fully taxable and must be reported. Most day care providers will use schedule c as their child care tax form. Daycares are required to provide the irs form 1098, which shows the total amount of qualifying expenses paid by the parents for. The form you receive from your daycare provider is called a.

Most day care providers will use schedule c as their child care tax form. Daycares are required to provide the irs form 1098, which shows the total amount of qualifying expenses paid by the parents for. The answer is yes, most daycares will provide you with a tax form. The form you receive from your daycare provider is called a. When you earn money as a daycare provider, even if only a small amount, those earnings are fully taxable and must be reported. Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of.

Most day care providers will use schedule c as their child care tax form. The answer is yes, most daycares will provide you with a tax form. When you earn money as a daycare provider, even if only a small amount, those earnings are fully taxable and must be reported. Daycares are required to provide the irs form 1098, which shows the total amount of qualifying expenses paid by the parents for. Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of. The form you receive from your daycare provider is called a.

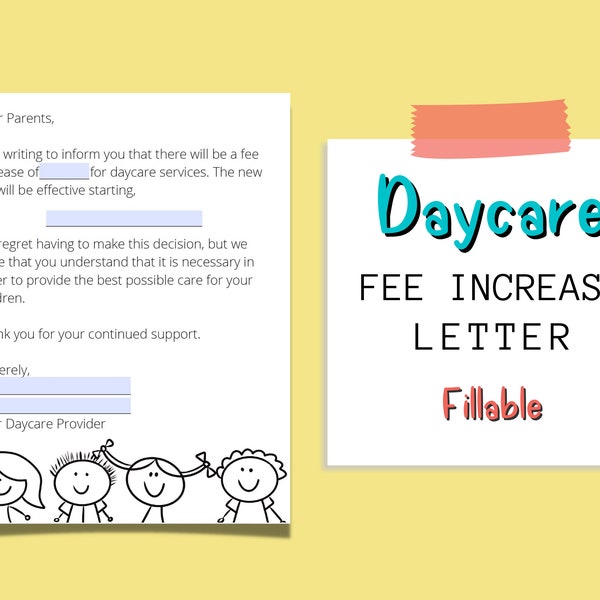

Home Daycare Tax Forms

Daycares are required to provide the irs form 1098, which shows the total amount of qualifying expenses paid by the parents for. Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of. The form you receive from your daycare provider is called a. Most day care providers will use schedule.

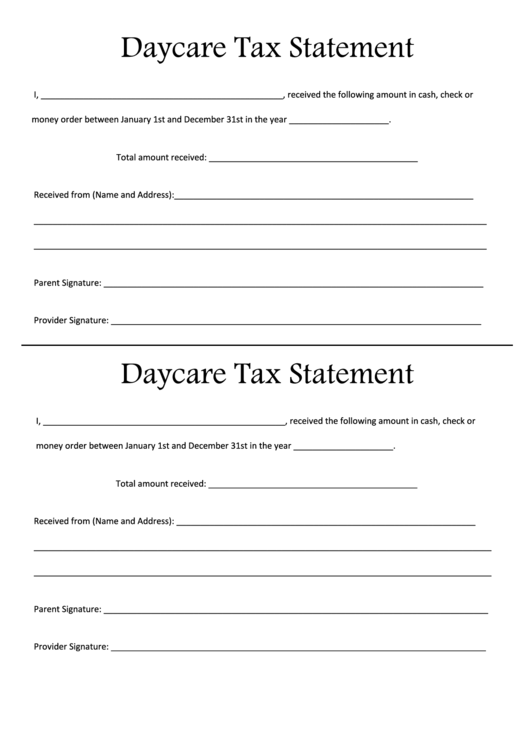

Tax Statement for Home Daycares Daycare Tax Receipts Daycare Tax

Most day care providers will use schedule c as their child care tax form. Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of. Daycares are required to provide the irs form 1098, which shows the total amount of qualifying expenses paid by the parents for. When you earn money.

Tax Deduction Guide for Daycares & Babysitters The Firm

The answer is yes, most daycares will provide you with a tax form. Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of. Most day care providers will use schedule c as their child care tax form. The form you receive from your daycare provider is called a. Daycares are.

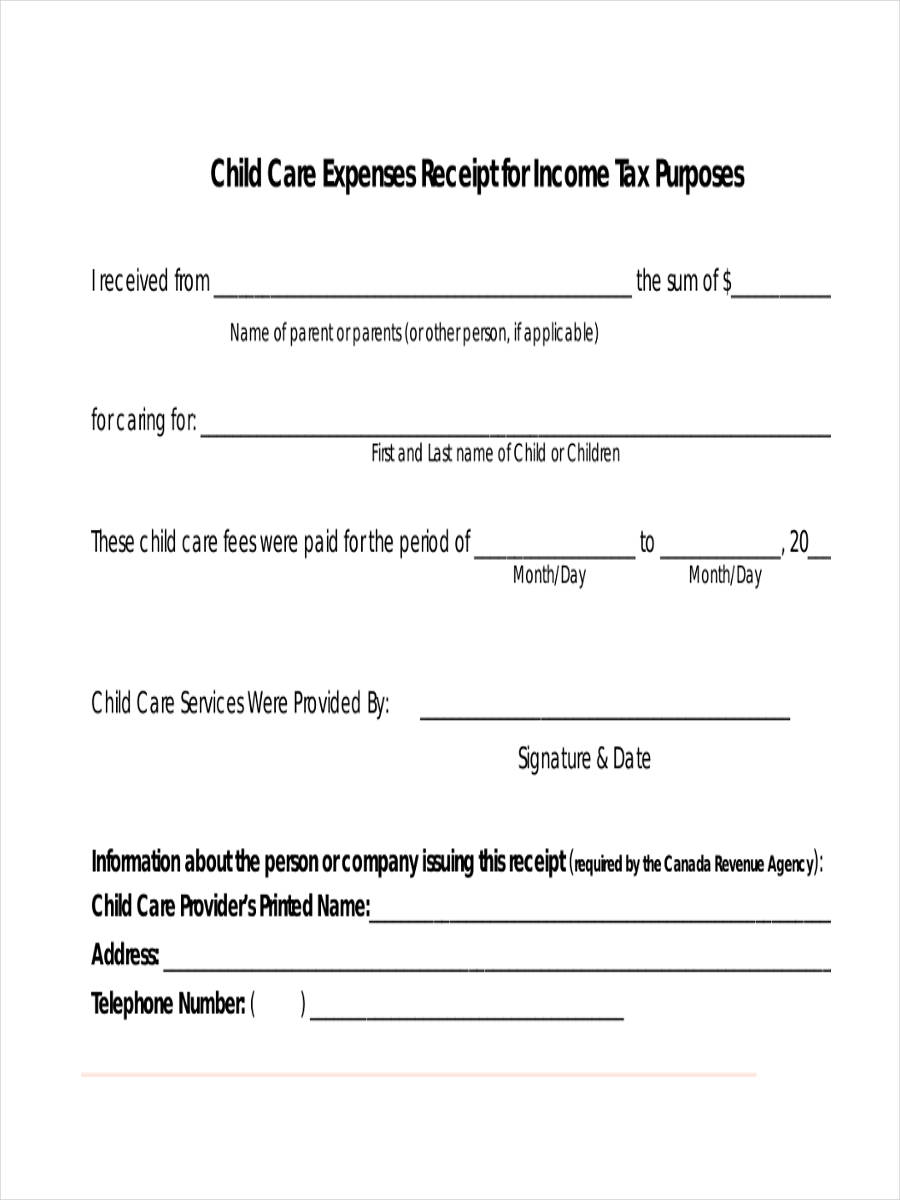

Top 7 Daycare Tax Form Templates free to download in PDF format

Daycares are required to provide the irs form 1098, which shows the total amount of qualifying expenses paid by the parents for. Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of. Most day care providers will use schedule c as their child care tax form. When you earn money.

Tax Statement for Home Daycares Daycare Tax Receipts Daycare Tax

When you earn money as a daycare provider, even if only a small amount, those earnings are fully taxable and must be reported. Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of. Most day care providers will use schedule c as their child care tax form. The form you.

Free Printable Daycare Tax Forms Printable Forms Free Online

The answer is yes, most daycares will provide you with a tax form. The form you receive from your daycare provider is called a. Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of. Most day care providers will use schedule c as their child care tax form. When you.

Tax Statement for Home Daycares Daycare Tax Receipts Daycare Tax

Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of. Most day care providers will use schedule c as their child care tax form. Daycares are required to provide the irs form 1098, which shows the total amount of qualifying expenses paid by the parents for. When you earn money.

Tax Deductions for Home Daycares HOW TO START A HOME DAYCARE in 2022

When you earn money as a daycare provider, even if only a small amount, those earnings are fully taxable and must be reported. Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of. Most day care providers will use schedule c as their child care tax form. The answer is.

Free Printable Daycare Tax Forms For Parents

Most day care providers will use schedule c as their child care tax form. Daycares are required to provide the irs form 1098, which shows the total amount of qualifying expenses paid by the parents for. The form you receive from your daycare provider is called a. When you earn money as a daycare provider, even if only a small.

Daycare Printable Tax Forms Printable Forms Free Online

Daycares are required to provide tax forms to parents, but there are some exceptions and nuances to be aware of. Daycares are required to provide the irs form 1098, which shows the total amount of qualifying expenses paid by the parents for. Most day care providers will use schedule c as their child care tax form. The form you receive.

The Answer Is Yes, Most Daycares Will Provide You With A Tax Form.

Daycares are required to provide the irs form 1098, which shows the total amount of qualifying expenses paid by the parents for. The form you receive from your daycare provider is called a. When you earn money as a daycare provider, even if only a small amount, those earnings are fully taxable and must be reported. Most day care providers will use schedule c as their child care tax form.