Discharge Tax Debt In Bankruptcy - Find out which types of tax. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. Find out what types of bankruptcy are available, how to notify. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. Learn how bankruptcy affects your federal tax obligations and options. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. While in an open bankruptcy.

Learn how bankruptcy affects your federal tax obligations and options. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Find out what types of bankruptcy are available, how to notify. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. Find out which types of tax. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. While in an open bankruptcy. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions.

Learn how bankruptcy affects your federal tax obligations and options. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Find out what types of bankruptcy are available, how to notify. While in an open bankruptcy. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. Find out which types of tax. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet.

Discharge Taxes in Bankruptcy Dischargeability Analysis

Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. Learn how bankruptcy affects your federal tax obligations and options. Find out what types of bankruptcy are available, how to notify. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. You.

Does Bankruptcy Discharge My Tax Debt?

While in an open bankruptcy. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. Find out which types of.

Form 982 IRS How to Reduce Your Tax Liability Through Debt Discharge?

While in an open bankruptcy. Learn how bankruptcy affects your federal tax obligations and options. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Find out which types of tax.

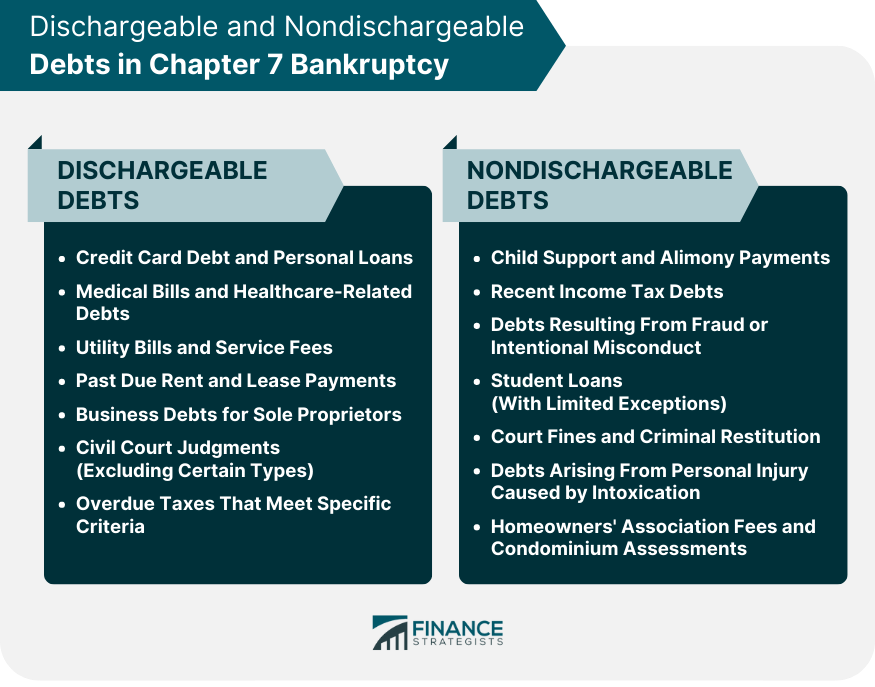

What Debts Are Discharged in Chapter 7 Bankruptcy?

Find out which types of tax. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Learn how bankruptcy affects your federal tax obligations and options..

Chapter 13 Bankruptcy Can IRS Debt be Discharged? Internal Revenue

Find out which types of tax. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. While in an open bankruptcy. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. Some filers can discharge or wipe out tax debts in chapter.

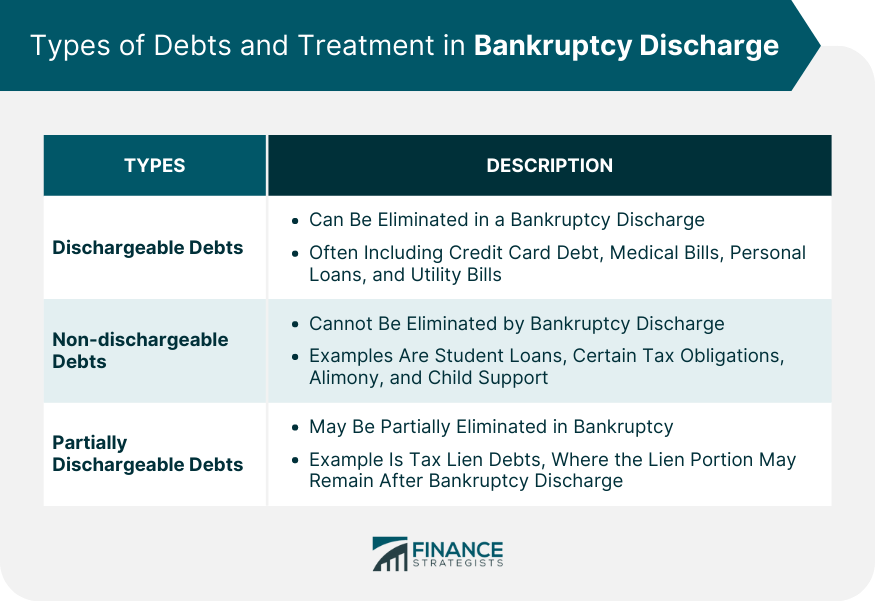

How Bankruptcy Gets Discharged Overview, Impact, Prevention

Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Learn how bankruptcy affects your federal tax obligations and options. While in an open.

What Debts Are Discharged in Chapter 7 Bankruptcy?

When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. While in an open bankruptcy. Find out which.

Do You Have to Pay Taxes on Discharged Bankruptcy Debt?

While in an open bankruptcy. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. Find out what types of bankruptcy are available, how to notify. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. When determining whether they can discharge.

Identifying Bankruptcy Discharge Tax Debt IRS Solutions

Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. A bankruptcy discharge may provide.

How Does a Bankruptcy Discharge Work? Lexington Law

Find out what types of bankruptcy are available, how to notify. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. While in an open bankruptcy. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. Learn how bankruptcy affects your federal tax obligations and options.

Federal Income Tax Debt Can Be Discharged By Bankruptcy, But Only Under Very Specific Conditions.

Learn how bankruptcy affects your federal tax obligations and options. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet.

A Bankruptcy Discharge May Provide Relief To A Taxpayer By Reducing Or Eliminating Certain Debts.

Find out which types of tax. While in an open bankruptcy. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Find out what types of bankruptcy are available, how to notify.