Can Payday Loans Be Discharged In Chapter 7 - Can i discharge payday loans in chapter 7 bankruptcy? You can and should list the payday loans in your chapter 7 bankruptcy. This is a quick reminder that most payday loans or cash advance loans can be discharged in chapter 7 bankruptcy if they are. Yes, payday loans are typically considered unsecured debt, which means they. However, you should be aware that if the lender files an. In most cases, you can wipe out or discharge a payday loan in chapter 7 bankruptcy or pay a small portion in chapter 13 bankruptcy. Most unsecured personal loans, such as payday loans and other forms of consumer debt, can be discharged in chapter 7 bankruptcy. Payday loans areunsecured debt because there is no collateral (debtor’s personal property) securing repayment of the loan.

This is a quick reminder that most payday loans or cash advance loans can be discharged in chapter 7 bankruptcy if they are. Most unsecured personal loans, such as payday loans and other forms of consumer debt, can be discharged in chapter 7 bankruptcy. Yes, payday loans are typically considered unsecured debt, which means they. You can and should list the payday loans in your chapter 7 bankruptcy. Payday loans areunsecured debt because there is no collateral (debtor’s personal property) securing repayment of the loan. Can i discharge payday loans in chapter 7 bankruptcy? However, you should be aware that if the lender files an. In most cases, you can wipe out or discharge a payday loan in chapter 7 bankruptcy or pay a small portion in chapter 13 bankruptcy.

This is a quick reminder that most payday loans or cash advance loans can be discharged in chapter 7 bankruptcy if they are. Most unsecured personal loans, such as payday loans and other forms of consumer debt, can be discharged in chapter 7 bankruptcy. Yes, payday loans are typically considered unsecured debt, which means they. Can i discharge payday loans in chapter 7 bankruptcy? In most cases, you can wipe out or discharge a payday loan in chapter 7 bankruptcy or pay a small portion in chapter 13 bankruptcy. You can and should list the payday loans in your chapter 7 bankruptcy. However, you should be aware that if the lender files an. Payday loans areunsecured debt because there is no collateral (debtor’s personal property) securing repayment of the loan.

How Payday Loans Can Help You Meet your Financial Goals

You can and should list the payday loans in your chapter 7 bankruptcy. Can i discharge payday loans in chapter 7 bankruptcy? This is a quick reminder that most payday loans or cash advance loans can be discharged in chapter 7 bankruptcy if they are. Most unsecured personal loans, such as payday loans and other forms of consumer debt, can.

Can Student Loans be Discharged in a Chapter 7 Bankruptcy?

Most unsecured personal loans, such as payday loans and other forms of consumer debt, can be discharged in chapter 7 bankruptcy. Payday loans areunsecured debt because there is no collateral (debtor’s personal property) securing repayment of the loan. Can i discharge payday loans in chapter 7 bankruptcy? You can and should list the payday loans in your chapter 7 bankruptcy..

How to Get Out of Paying Back a Payday Loan (Legally)

However, you should be aware that if the lender files an. Most unsecured personal loans, such as payday loans and other forms of consumer debt, can be discharged in chapter 7 bankruptcy. Payday loans areunsecured debt because there is no collateral (debtor’s personal property) securing repayment of the loan. You can and should list the payday loans in your chapter.

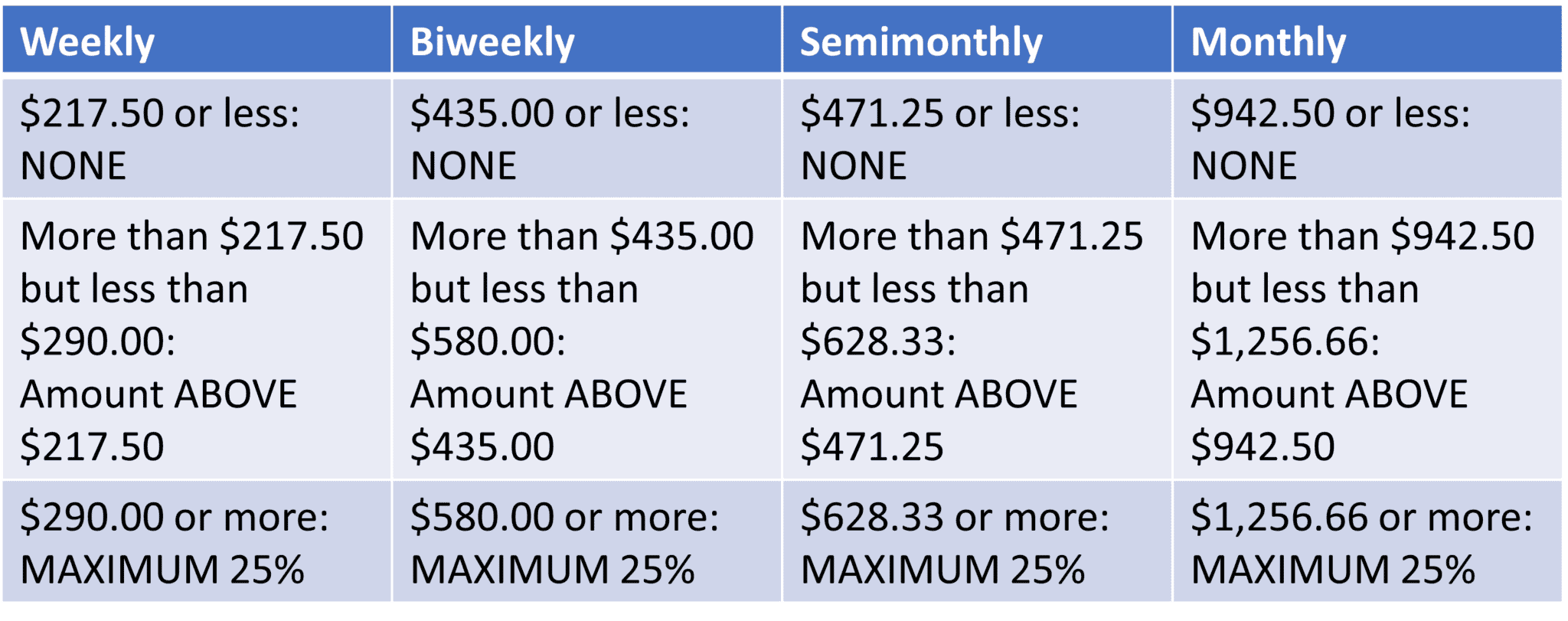

Can Payday Loans Garnish Your Wages?

You can and should list the payday loans in your chapter 7 bankruptcy. In most cases, you can wipe out or discharge a payday loan in chapter 7 bankruptcy or pay a small portion in chapter 13 bankruptcy. However, you should be aware that if the lender files an. Most unsecured personal loans, such as payday loans and other forms.

A Helpful Guide on How to Get a Payday Loan iStoryTime

Yes, payday loans are typically considered unsecured debt, which means they. Most unsecured personal loans, such as payday loans and other forms of consumer debt, can be discharged in chapter 7 bankruptcy. This is a quick reminder that most payday loans or cash advance loans can be discharged in chapter 7 bankruptcy if they are. However, you should be aware.

Tips To Get Approved For Instant Payday Loans Online Serendipity Mommy

In most cases, you can wipe out or discharge a payday loan in chapter 7 bankruptcy or pay a small portion in chapter 13 bankruptcy. This is a quick reminder that most payday loans or cash advance loans can be discharged in chapter 7 bankruptcy if they are. Can i discharge payday loans in chapter 7 bankruptcy? You can and.

Can Payday Loans Garnish Your Wages?

In most cases, you can wipe out or discharge a payday loan in chapter 7 bankruptcy or pay a small portion in chapter 13 bankruptcy. Can i discharge payday loans in chapter 7 bankruptcy? Payday loans areunsecured debt because there is no collateral (debtor’s personal property) securing repayment of the loan. You can and should list the payday loans in.

Can Student Loans Be Discharged in Bankruptcy? Bankruptcy

This is a quick reminder that most payday loans or cash advance loans can be discharged in chapter 7 bankruptcy if they are. Most unsecured personal loans, such as payday loans and other forms of consumer debt, can be discharged in chapter 7 bankruptcy. In most cases, you can wipe out or discharge a payday loan in chapter 7 bankruptcy.

Can Payday Loans Be Discharged In Bankruptcy? YouTube

In most cases, you can wipe out or discharge a payday loan in chapter 7 bankruptcy or pay a small portion in chapter 13 bankruptcy. Most unsecured personal loans, such as payday loans and other forms of consumer debt, can be discharged in chapter 7 bankruptcy. Payday loans areunsecured debt because there is no collateral (debtor’s personal property) securing repayment.

What Is a Bankruptcy Discharge?

Payday loans areunsecured debt because there is no collateral (debtor’s personal property) securing repayment of the loan. However, you should be aware that if the lender files an. Most unsecured personal loans, such as payday loans and other forms of consumer debt, can be discharged in chapter 7 bankruptcy. You can and should list the payday loans in your chapter.

However, You Should Be Aware That If The Lender Files An.

You can and should list the payday loans in your chapter 7 bankruptcy. Payday loans areunsecured debt because there is no collateral (debtor’s personal property) securing repayment of the loan. In most cases, you can wipe out or discharge a payday loan in chapter 7 bankruptcy or pay a small portion in chapter 13 bankruptcy. This is a quick reminder that most payday loans or cash advance loans can be discharged in chapter 7 bankruptcy if they are.

Most Unsecured Personal Loans, Such As Payday Loans And Other Forms Of Consumer Debt, Can Be Discharged In Chapter 7 Bankruptcy.

Yes, payday loans are typically considered unsecured debt, which means they. Can i discharge payday loans in chapter 7 bankruptcy?

:max_bytes(150000):strip_icc()/bankruptcy-discharge-what-is-it-and-when-does-it-happen-8eafb0f711c24a048d4854a82cdb5f70.png)